Can India address the Achilles’ heel in its supply chain to become the true ‘pharmacy’ of the world?

By Kislay Ranjan, Sr. Manager of Strategic & Foreign Relations Practice at Rashtram

This article was published in the New World Order.

Image Source: New World Order

COVID-19 has again reiterated the fact that India is rightly called the ‘Pharmacy of the World.’ Many countries have requested medicines from India in this crisis. Developed countries like the US for Hydroxychloroquine and UK for Paracetamol have thanked India for its timely help and admired its leadership in these testing times. India, at present, has cleared the list for fifty-five countries and is processing more requests. Naturally, this has increased the goodwill of India in the international arena. The clearance to export drugs by Indian companies like LUPIN and BIOCON to the US market by the Food and Drug Agency(USFDA) is an indicator of the effect of that goodwill. If India can build on this goodwill more, it can become the most crucial player in the global supply chain in terms of pharmaceuticals and even other commodities.

However, before that, India will have to address the Achilles heel in this supply chain. It is highly dependent on China for its supply of Active Pharmaceutical Ingredients (API), which are the key ingredients for producing medicines. As the cases of COVID-19 grew, the exports of APIs have been slow. Indian government admitted that it had three months of stocks left at the current conditions. To meet the high demand for medicines like Hydrochloroquine, the manufacturers in India have asked the government to airlift the APIs from China. With high prices of APIs due to these issues, the final products will become costlier, and that would negate the competitive advantage of Indian exports. That’s a significant chink in the armor, and India needs to address this problem.

Understanding the dependence on China

To understand the dependence on China, we first need to understand the emergence of the global supply chain. The inception of the global supply chain of pharmaceuticals happened with the WTO Agreement on Trade in Pharmaceutical Products Agreement. This agreement, which came into force in 1995, eliminated tariffs on pharmaceutical products between the US and other member countries. India, after joining WTO in 1995, and China, in 2001, hugely benefited from this agreement.

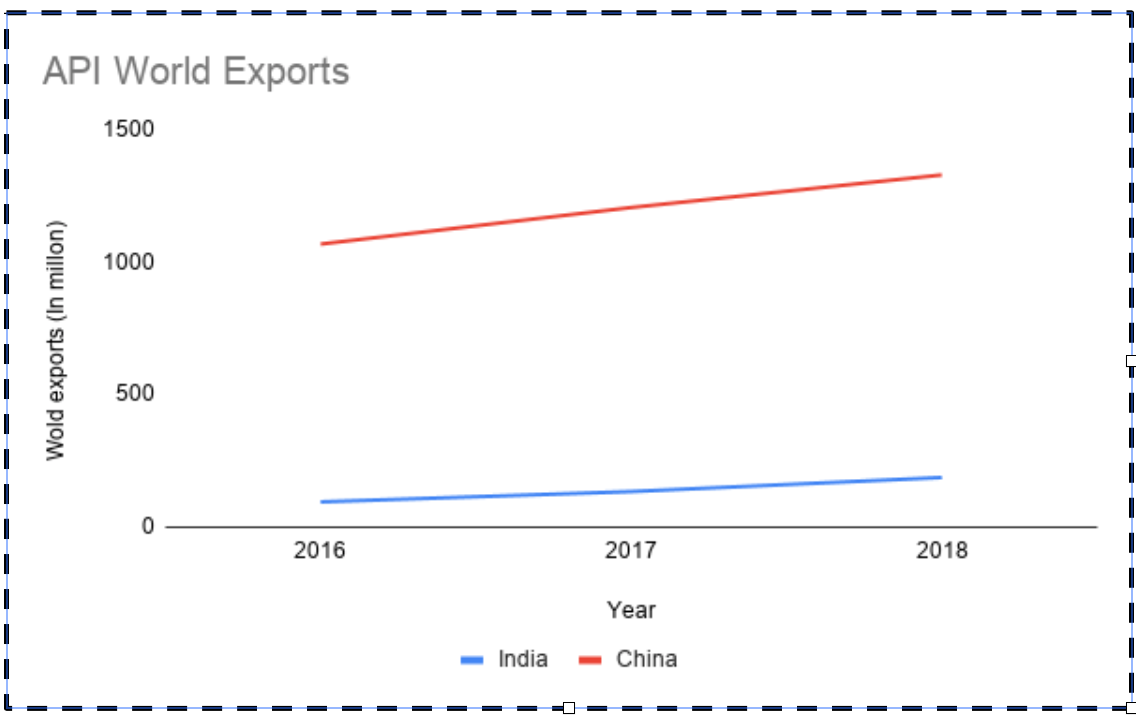

China exported 8.8 Billion USD worth of drugs to the world in 2018. Indian exports eclipsed the Chinese exports in that year at 14.3 Billion USD. However, this doesn’t give the whole picture as India is dependent on China for its APIs.

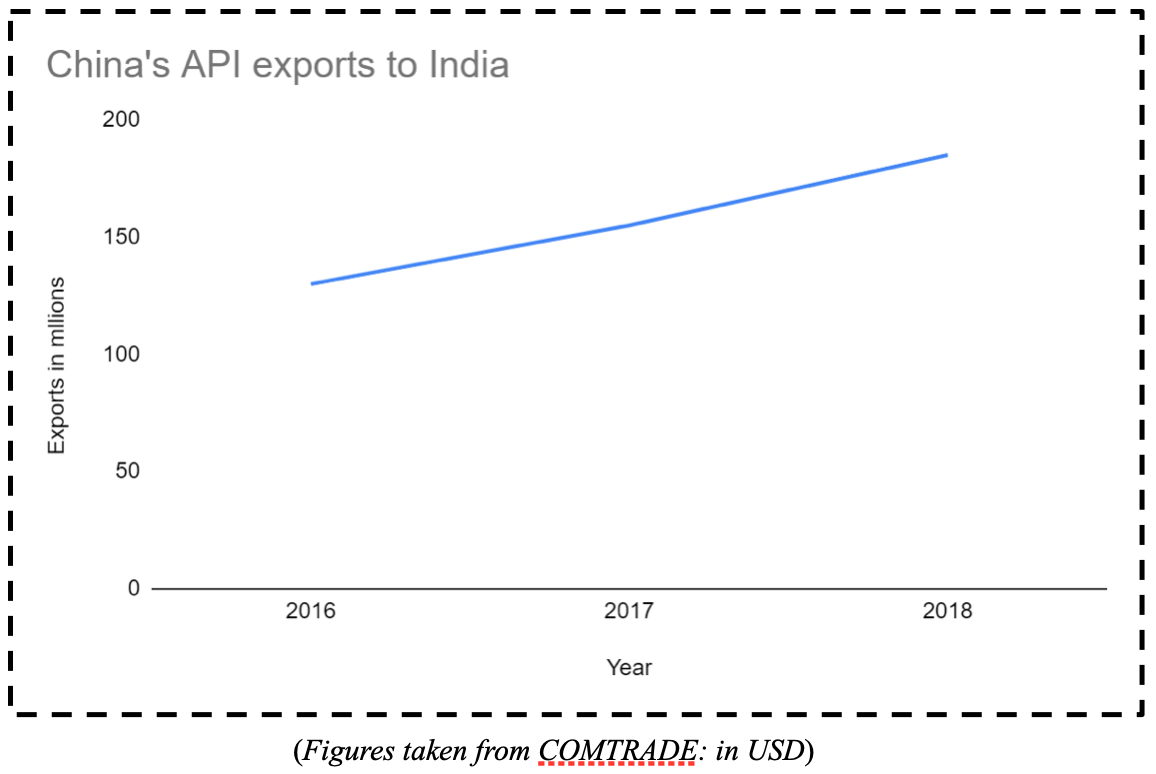

In the case of APIs, the Chinese exports to the world were USD 1.33 Billion USD in 2018 as compared to 0.185 Billion USD shipped by India. In fact, in the same period, India imported 0.186 Billion USD of APIs from China. These imports have generally followed an increasing trend, and that demonstrates the dependence of the world on China for APIs. According to an admission by the Ministry of Chemicals and Fertilizers , India imports two-thirds of APIs from China.

How did we reach here?

Till the early 90s, India was self-reliant in producing APIs. However, due to imports at highly competitive prices from China, the manufacturing capacity in India started suffering. The reason for this is that the sustained flow of low-cost capital and comparatively lower wages in China resulted in flooding the international market with Chinese APIs at competitive prices. In time, the world started recognizing China as the leading exporter and relied on it to meet its demand. In this process, Indian lowered its production of APIs. At present, the API manufacturers in India run at a capacity of 30% as compared to 70% in China.

China became the world leader in manufacturing APIs by providing low-cost capital, low material costs, and wages along with lax environmental regulations for the harmful chemicals which get produced with the result. APIs are formed when raw material passes through many intermediate chemical processes in a reactor. Since this is a capital intensive process, the supply of low-cost capital helps to sustain it. Moreover, those chemical reactions produce a lot of waste, the disposal of which is a significant environmental concern.

However, there have been issues in manufacturing APIs in China. Chinese manufacturers have been moving away from APIs due to the rising cost of funds and wages. Also, the Chinese government’s insistence on addressing the environmental concern of waste disposal is adding to the cost making the Chinese move away from API further. There is also a factor of language barriers as the Chinese are not well-versed with the English language. This barrier is an issue in a country like the US, where the filing of Drug Master Files, which are used to provide details about manufacturing, process, and storage details to the FDA. These filings require strong language skills. Hence, issues like this and others can be an opening for India to regain its lost ground.

Ways forward

It’s not that the Indian governments through the years have not taken cognizance of this issue. A committee under Dr. V.M. Katoch, former Secretary, Department of Health and Research was formed in 2013 by the government at that time. On 21 March 2020, the union cabinet decision to boost API productions incorporated some of the recommendations of that committee.

The decisions were divided into two parts-

- Promotion of Bulk Drugs Parks- The plan is to develop three mega bulk drug parks in partnership with states with grant-in-aid from the Centre at INR 30 Billion per park. The parks shall have joint facilities like – solvent recovery plant, distillation plants and power, and steam units, etc.

- Production Linked Incentive Scheme for Manufacturers – The GOI will give financial incentives to eligible manufacturers of 53 critical bulk drugs on their incremental sales in the base year (2019-2020) for six years. The rate of incentives shall be 20% for 26 fermentation-based bulk drugs and 10% for 27 chemical-based bulk drugs. An amount of INR 69.4 Billion has been allotted in this regard.

The measures mentioned above are suitable for long term capacity building, but for our immediate need to medium need, we require some different strategies. We need to airlift the crucial APIs from China requested by the Indian manufacturers to meet our immediate needs. For the medium term, we may go for the following steps to meet our needs by boosting the existing manufacturers. The steps are-

- Projection of the demand for APIs to meet domestic and international demand for medicines.

- Audit of the existing manufacturing capacity.

- Providing capital incentive so that the whole burden doesn’t fall on the manufacturers.

- Ensuring an alternate supply chain for import of raw materials for API and exporting the finished products.

Conclusion

It will not be an easy task for India to regain its lost position in API productions. This will require sustained phase-wise efforts from the government and the private entities. However, COVID-19 has shown the need for these efforts, and now is the time to move towards that direction. If India is able to do that, it can truly emerge as the Pharmacy of the world.