From the time of Adam Smith to the more recent Behavioural Economics, there has been considerable churn over the last 250 years in the economic approach to understanding human nature. The article briefly examines the treatment of Indian Knowledge Systems into Human Nature and the promise of Artha, an Indian Economic philosophy repurposed and updated for the current era.

By Prashant Singh, Professor & Director of Centre for Innovation in Governance, and Manan Gandhi, Research Associate at Rashtram

The Basis: Importance of Understanding Human Nature

“Nothing is more fundamental in setting our research agenda and informing our research methods than our view of the nature of the human being whose behaviour we are studying.”- Herbert A. Simon, winner of the Nobel Prize in Economics in 1978 and the Turing Award in 1975. Knowledge of Human nature shapes virtually every touchpoint in public policy, social sciences, health, economics, education and more.

Applied knowledge of Human nature creates, manipulates, and shapes human desires transforming them from visions in the realms of the subtle worlds into quantifiable demand that shapes tangible businesses run in accordance with the modern industrial-economic calculus. These formulations help create analytical tools to design advertisements to attract consumers, negotiating tactics, product pricing, and even firm-level competitive strategy in the microeconomic sphere.

Such questions are increasingly and predominantly resolved by making analytical models based on understanding the nature of human behaviour. From the time of Adam Smith to the more recent Behavioural Economics, there has been considerable churn over the last 250 years in the economic approach to understanding human nature. The article also briefly examines the treatment of Indian Knowledge Systems into Human Nature and the promise of Artha, an Indian Economic philosophy repurposed and updated for the current era.

Understanding Human Nature in Modern Economics: The Invisible Hand, Homo Economicus, Bounded Rationality, and Behavioural Economics

The understanding of Human Nature in Modern Economics has evolved. Some of the key elements include the terms: The Invisible Hand, Homo Economicus, the Bounded Rationality Model, and the more recent branch of Behavioural Economics, which are examined in this section.

According to a paper by Emma Rothschild, Adam Smith, the father of modern Economics, used the term “The Invisible Hand” on three occasions.

The first usage, according to Rothschild, was with a “sardonic” view in his History of Astronomy, where he wrote about the “credulity of people in polytheistic societies, who ascribe the ‘irregular events of nature” such as thunder and storms to ‘intelligent but invisible beings…’.

The second usage by Adam Smith is in The Theory of Moral Sentiments, published in 1759. Here he uses it in the context of business proprietors who, as they pursue narrow selfish interests, are unconcerned with humanitarian or other nobler aims. According to Adam Smith, as they employ thousands of poor workers, “they are led by an invisible hand to…without intending it, without knowing it, advance the interest of the society”.

It is in the third usage of “Invisible Hand” in An Inquiry into the Nature and Causes of the Wealth of Nations (1776), where the Invisible Hand is described as a general mechanism that guides action from the context of protectionism in an International Trade scenario.

Adam Smith compares the universe with a machine by saying “the various appearances which the great machine of the universe is perpetually exhibiting, with the secret wheels and springs which produce them.” He further says, “The administration of the great system of the universe [and] the care of the universal happiness of all rational and sensible beings, is the business of God, and not of man. To man is allotted a much humbler department, but one much more suitable to the weakness of his powers, and to the narrowness of his comprehension-the care of his own happiness, of that of his family, his friends, his country.”

R.H. Coase, while describing Adam Smith’s View Of Man, concludes the article by saying, “He thinks of man…. by self-love but not without some concern for others, able to reason but not necessarily in such a way as to reach the right conclusion, seeing the outcomes of his actions but through a veil of self-delusion.”

The critical human characteristics relevant to economics are the fundamental needs of a human being, the motive or purpose behind any human activity, and the psychological processes through which needs are met. These essential characteristics are used as the basis for simulating how man interacts with the rest of society to meet its various needs. One of the first portrayals of man was that of Homo Economicus. There are a bunch of postulates on which the theory of Homo Economicus is built. These postulates state that any real-world happening is the product of individual actions. These actions are decipherable and a product of logical reasoning in the human brain. The human brain is assumed to be capable of performing complex calculations to optimize its own returns. Therefore, the actors are concerned with the consequences of actions to themselves, i.e. they are narrowly selfish.

However, these assumptions do not adequately explain many real-world empirical data. The Nobel Laureate, Gary Becker said, “The way I like to put it is that we have to have a dialogue between the theory or model and the data. Theory informs us about what data to look at and how to interpret the data. But data also informs the theory. So if you have theoretical predictions that continue to turn out wrong, you have to change the theory.”

Criticizing the conventional perception, Ernst Fehr and Simon Gachter state, “On the basis of assumptions of rationality and selfishness, economists have constructed a remarkable body of theoretical knowledge. However, there remains the question whether the exclusive reliance on rationality and selfishness is capable of explaining people’s actual behaviour.”

Not all economists believed humans have an infinite brain capacity or complete knowledge to make an optimized decision. This resistance led to the emergence of the concept of Bounded Rationality.

Bounded Rationality states that it is not just essential to look at the result but also the process of attaining the result. The psychological and cognitive constraints that were not yet considered in the Homo Economicus models started to emerge in the bounded rationality model. To make an optimized decision, it was necessary to know all the possible alternatives and the consequences of following each alternative with certainty. It was also needed to perform complex calculations and logical deductions to maximize the utility. However, economics started to acknowledge that it was not realistic to assume so. Thus theories began to consider that human beings were rational but within their individual limits.

In support of Bounded Rationality theory, Herbert Simons stated, “rational behaviour in the real world is as much determined by the “inner environment” of people’s minds, both their memory contents and their processes, as by the “outer environment” of the world on which they act, and which acts on them”.

In yet another critique of Homo Economicus portrayals, Raymond Boudon says, “Even scientists can hold false beliefs through passion or other irrational causes. What I am saying is that belief in false ideas can be caused by reasons in the mind of the actors….Even though these reasons appear false to us, they may be perceived to be right and strong by the actors themselves”. Boudon further says, “that social action generally depends on beliefs; that as far as possible, beliefs, actions, and attitudes should be treated as rational, or more precisely, as the effect of reasons perceived by social actors as strong; and that reasons dealing with costs and benefits should not be given more attention than they deserve. Rationality is one thing, expected utility another.”

One of the portrayals of human beings in the Bounded Rationality theory is that of a satisficer. Instead of being a maximizer, a satisficer has a reference level or threshold quantity of needs, and he will try to satisfy those needs without putting too much effort into the calculations. Satisficers don’t always act out of self-interest but for several other reasons: morals, justice, service, or social norms. Herbert Simons, who coined this term by combining ‘satisfying’ and ‘suffice’, said in his Nobel Prize speech that decision-makers can satisfice either by finding optimum solutions for a simplified world, or by finding satisfactory solutions for a more realistic world. Since then, many such cognitive heuristics have arisen, and the whole field of Behavioural Economics has become popular.

Richard Thaler, a Nobel Prize winner for his work in the field of Behavioural Economics, said, “On the theory side, the basic problem is that we are relying on one theory to accomplish two rather different goals, namely to characterize optimal behavior and to predict actual behaviour. We should not abandon the first type of theories as they are essential building blocks for any kind of economic analysis, but we must augment them with additional descriptive theories that are derived from data rather than axioms.”

Thaler suggests that Behavioural Economics should focus on the empirical data to predict human nature rather than the conceptual formation that aims at the human’s optimal behaviour. He further says, “Behavioral economics simply replaces Econs (Homo Economicus) with Homo sapiens, otherwise known as Humans.”

Behavioural Economics makes a study of heuristics, biases, and inclinations undertaken by human brains to make decisions. These short-cuts human beings have evolved to ease decision-making from doing complex calculations and extensive efforts. These short-cuts are used commonly by all, and thus humans have been termed as ‘predictably irrational’. Behavioural Economist Mathew Rabin developed three deviations from the Homo Economicus model. He referred to them as ‘non-standard preferences’, ‘non-standard beliefs’, and ‘non-standard decision making’. Non-standard preferences such as altruism and reciprocity, non-standard beliefs such as extrapolation, and non-standard decision making such as framing effect are considered in this approach.

From Adam Smith talking about subtle, invisible forces to optimizing maximizing behaviour to satisficing behaviour to biases and heuristics, the economic approach to human behaviour has seen a major change. The new methods have been added to the previous research to make it more encompassing and realistic as much as possible. However, there is still a long way to give a coherent theory and explain empirical findings comprehensively which implies that modern Economic models are still at a nascent stage of their evolution.

Building a Roadmap beyond Modern Economics: Developing the Case for Artha

The Indic Knowledge Systems (IKS) approach to Human Nature has surprisingly not been considered for adoption in mainstream academia. As we will see further in subsequent articles, IKS offers considerable promise in providing an integrated, coherent approach capable of offering great insights and explanatory power. We will explore various aspects of developing an Indic approach based on a vast body of work already existing to describe the Human Nature in Indic Knowledge Systems (IKS) and where possible, compare it with the modern approaches.

Curiously, as we review the seminal work done by modern economists, it is clear that there is a conspicuous absence or perhaps an avoidance of all IKS constructs. The term IKS is a broad term that includes among many other Indian traditional knowledge systems and practices, knowledge from Vedic & Vedanta resources, and other schools of Darshana, the Grammar, Syntax, Language and Mathematical disciplines.

The understanding of Human Nature in IKS is not merely an imaginary philosophical construct. Moreover, by no means is it intellectually fair to append the “sardonic” tag applied by Adam Smith to “polytheistic” societies to “intelligent but invisible beings”.

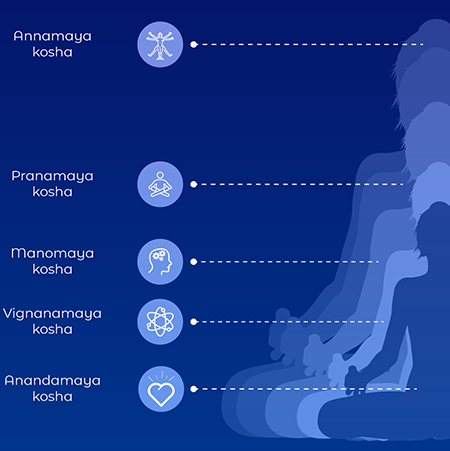

The “invisible beings” that are central to understanding Human Nature in IKS find applications in diverse fields such as Health (Ayurveda), Entertainment & Arts (the Kalas), Physical & Spiritual Evolution (Yoga), Justice (Nyaya), and Economic Development (Artha). IKS has a long and incredibly diverse knowledge system of working with “invisible beings” referred to by Adam Smith. On the right is a representation of the PanchaKosha (5 layers) model of a Human Being. Of the five layers, only one is gross in the physical dimension. The well-understood IKS practices of working with the Panchakosha is one of the models that will be examined in future work of Artha and understanding Human Nature for designing more Conscious Economic principles that go well beyond current themes. In addition, the relationship with sustainability, health, and rejuvenation are concepts that will be explored by future scholars who will need to invest in scholarship and study of the life-force principles in IKS.

The understanding of Human Nature from the IKS sciences and toolsets collectively provide the ability to explore the multiple dimensions of Human Behaviour, Life Forces and the nature of harmony, equilibrium states, and inter-dependency of Cause & Effect, Observation, and Observer and will be invaluable to construct a new model for a broader field of knowledge – Artha.

The concept of Artha was well developed in classical IKS literature and is one of the four parts of the Purushartha (literally the Meaning and Purpose of Man) framework. The four parts of Purushartha are Dharma (the rules that keep the cosmos integrated and together); Artha (Wealth in all its dimensions, Meaning and Purpose); Kama (the fulfillment of desires and experiences within the Dharma and Artha limits) and Moksha (the liberation or freedom of the Atman or individual soul from the entanglements in the fields of Dharma, Artha, and Kama).

The construct of Artha, based on the Indian Knowledge Systems, will need significant nurturing and development. Over a period of time, it is possible that with a deeper and more foundational understanding of Human Nature, Artha may well provide very significant value for Economists, Policy Planners, Business and Social Sector leadership, and for the larger Environment. Further, its deep integration with many applied fields holds the promise of many intersectionalities and new possibilities to emerge.

For this, much future work and scholarship is needed to build the development paradigms that engages with and resonates with the ethos already embedded in IKS to help create a more integral economic philosophy to address some of the pressing problems of inequality, non-inclusion, sustainability, health, education and economic livelihoods that provide purpose and prosperity.

The Center for Innovation in Governance at the Rashtram School of Public Leadership has selected Artha as one of the six themes where an innovation-based approach will help accelerate knowledge development, diffusion, deployment, and devolution.

References

- Simon, H. A. (1985). Human nature in politics: The dialogue of psychology with political science. The American political science review, 293-304.

- Rothschild, E. (1994). Adam Smith and the invisible hand. The American Economic Review, 84(2), 319-322.

- Smith, A. (2010). The Wealth of Nations: An inquiry into the nature and causes of the Wealth of Nations. Harriman House Limited.

- Coase, R. H. (1976). Adam Smith’s view of man. The Journal of Law and Economics, 19(3), 529-546.

- Gächter, S., & Fehr, E. (1998). How effective are trust-and reciprocity-based incentives?.

- Tan, E. (2014). Human capital theory: A holistic criticism. Review of Educational Research, 84(3), 411-445.

- Simon, H. A. (2000). Bounded rationality in social science: Today and tomorrow. Mind & Society, 1(1), 25-39.

- Boudon, R. (2003). Beyond rational choice theory. Annual review of sociology, 29(1), 1-21.

- Thaler, R. H. (2016). Behavioral economics: Past, present, and future. American Economic Review, 106(7), 1577-1600.